Interest Rates and What That Means for Your Business

April 12, 2022

In today’s world, new topics of media sensations are weekly occurrences. One subject matter that has been magnified for many months and remains relevant today is interest rates. As business owners, it is important to understand the impact interest rates can have on your business and how to minimize the negative effects.

As reported in the last NPSA Dispatch, the inflation numbers announced by the government are significantly understated. The Federal Reserve has been using quantitative easing to inject money into the economy by purchasing government bonds. They are employing this strategy because they cannot lower interest rates that are already near zero. Extremely low-interest rates encourage a liquidity trap; a situation where people prefer to hold their cash given the low returns on alternative financial assets. Loose monetary policy and a historically low Federal Funds Rate combined with quantitative easing have created our current environment.

The Federal Reserve has not increased interest rates in over three years. According to Fed Chair, Jerome Powell, this streak will be coming to an end. The Federal Reserve made it clear they expect three or more rate increases this year, starting in March. According to Bloomberg, “The economists, surveyed between Jan. 14-19, were about evenly split between expecting the Fed to hike three or four times in 2022 in response to a stronger U.S. labor market and the highest inflation in almost four decades”.

So, what happens when interest rates increase?

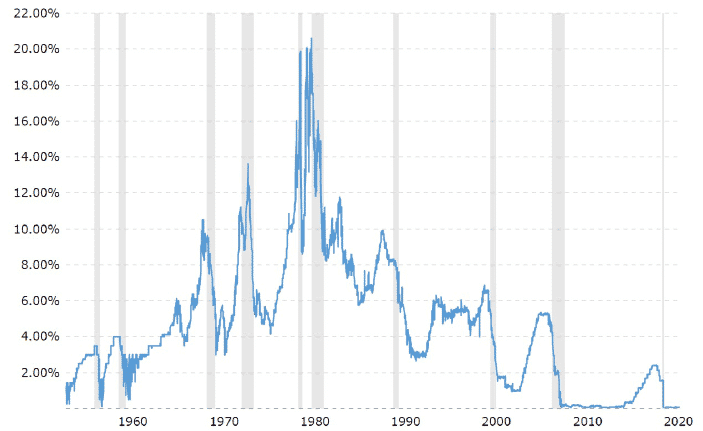

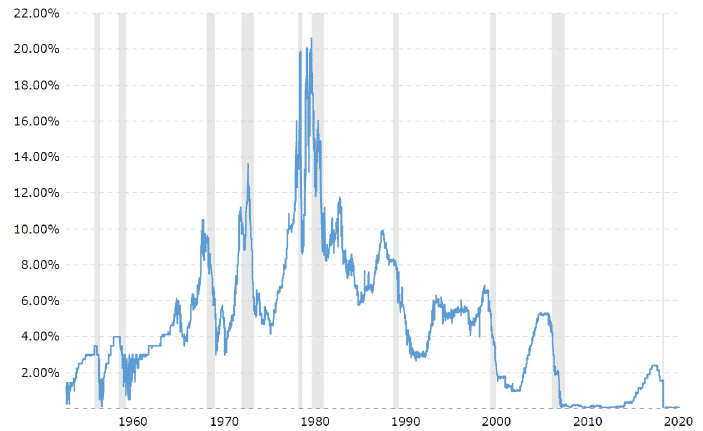

Throughout history, we have seen periods of steadily increasing interest rates. In the early 1980s, interest rates soared to 20%. During interest rate increases, history reveals that businesses and consumers will cut back on spending causing a tightening monetary policy by the banks to be inevitable.

The historical chart shows the federal funds rate over the last 60 years. The federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions.

Impact on Businesses

If history repeats itself, we can expect banks to tighten their monetary policy and pass these costs onto businesses which in turn will deter borrowing and impact business spending. It is important to note that experts do not believe we will see rate hikes as aggressive as we have in the past. Powell spoke of this by saying it is important to be “humble and nimble” and that “we’re going to be led by the incoming data and the evolving outlook.” Discussing the job market, Powell said, “There are many millions more job openings than there are unemployed people” and, “I think there’s quite a bit of room to raise interest rates without threatening the labor market.”

Increasing equipment costs have impacted every business. Global supply chains are struggling to produce and transport enough material to keep pace with the demand. There is optimism these rate increases will deter enough investment to allow the supply chains to “catch up.” This is yet to be seen, however, and the impact will be unknown until the effect has already taken place.

According to the Federal Reserve Senior Loan Officer Survey, lending standards continued to ease in Q3 of 2021 while demand for business loans was strong. Currently, however, we are seeing inflation in the new and used equipment market. It is not uncommon to see a three-year-old piece of equipment selling at or near its initial purchase price. This marked inflation will cause banks to take a more risk-based approach to financing by tightening lending standards. Should this happen, your business may need to consider using a nontraditional lender who can fund faster based on their risk tolerance and approval process.

Purchasing equipment is a pivotal decision for any business owner. Spending cash or using an equipment financing company to purchase the necessary equipment is a decision requiring analysis. Using cash to buy assets in a time of inflation is tricky. If inflation rises, cash will lose purchasing power and a dollar tomorrow will buy less than before. However, if inflation declines then that dollar spent yesterday will gain value today. One way to limit this exposure is through equipment financing. This option guarantees a fixed monthly payment for a set number of months, ensuring no increase or decrease in your monthly payments. This allows your business to budget accurately while providing security to your bank account.

Asset ownership is essential to the storage industry. Asking the right questions and finding a lending provider that is knowledgeable within the industry is crucial. During times of inflation with the increasing price of goods and rising interest rates, your resource to capital is more important than ever.